Blockchain technology has spawned two giants: Bitcoin and Ethereum, which have shaped the current landscape. Although they are similar at their core, a simple comparison simplifies their complexity. While Bitcoin is like a calculator, Ethereum is like a smartphone: more versatile and powerful. Designed as electronic money, Bitcoin focuses on being a medium of exchange and a store of value.

On the other hand, Ethereum, designed as a versatile platform, enables decentralized applications and smart contracts, opening up a range of possibilities from decentralized finance to non-fungible tokens. In this article, we will explore their differences and their implications for the technology sector.

History and development

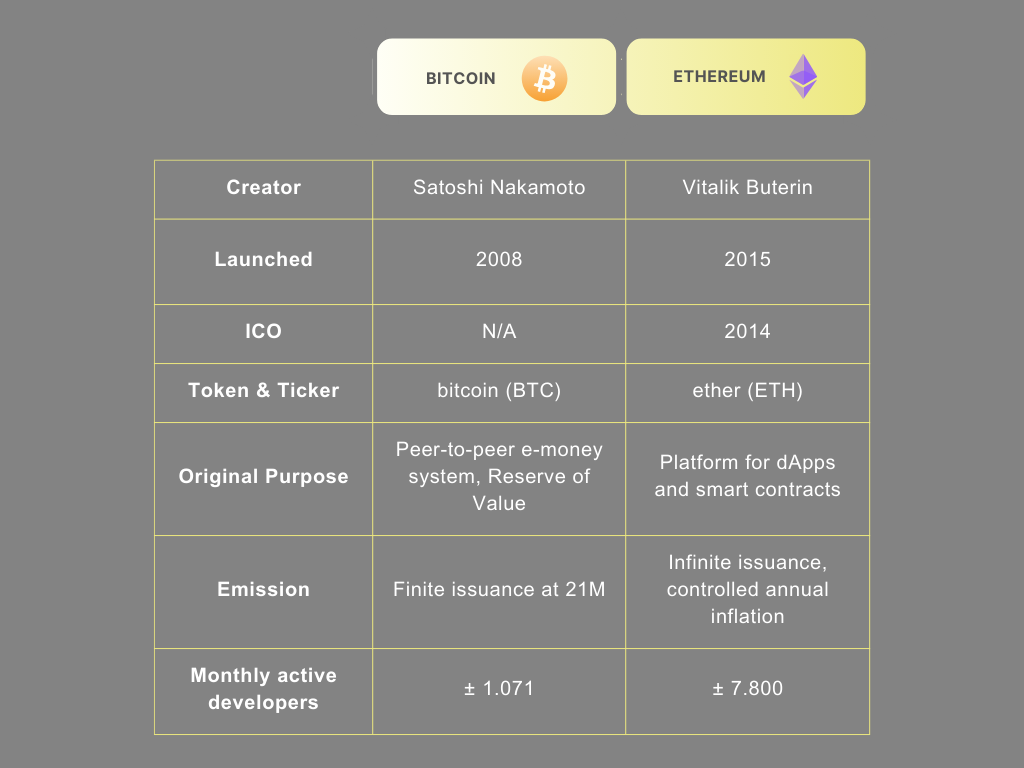

The history and development of Bitcoin and Ethereum provide unique insights into their original purposes and the evolution they have undergone over the years.

While Bitcoin was created with the intention of being a decentralized digital currency, Ethereum was created to expand the scope of blockchain technology beyond financial transactions, enabling the execution of smart contracts and the development of decentralized applications.

Below, we highlight the fundamental aspects of the origin and development of both Bitcoin and Ethereum:

Network architecture

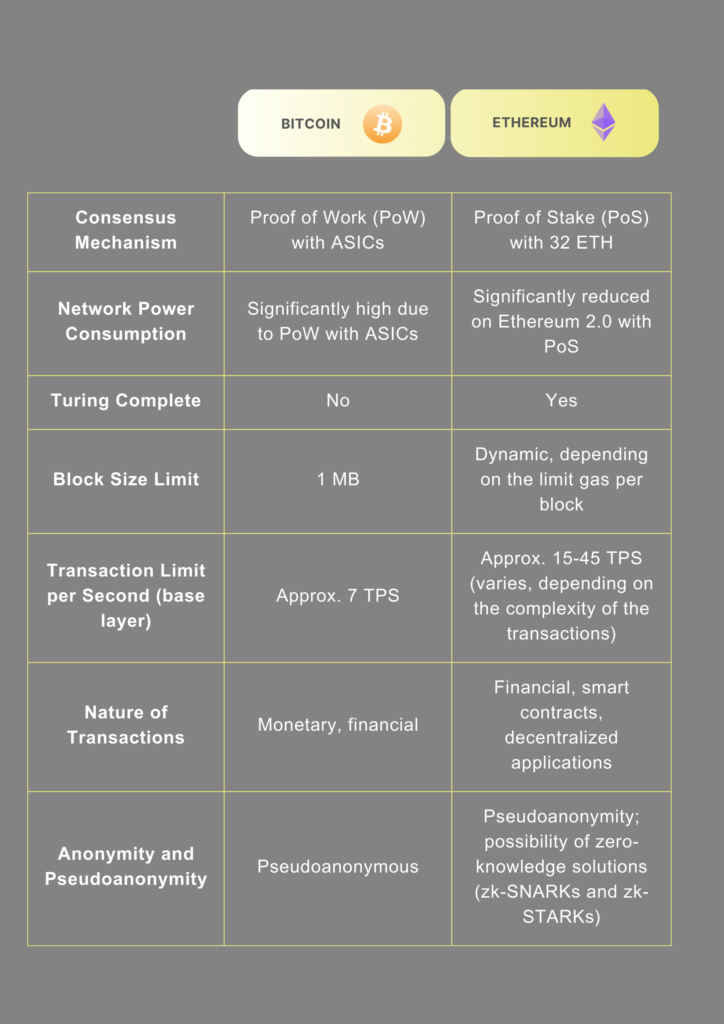

Exploring the network architecture and consensus mechanisms of Bitcoin and Ethereum allows us to understand how these two platforms have addressed fundamental issues such as security, efficiency and scalability. Bitcoin, designed as a digital cash system, chose Proof of Work (PoW) to ensure the security and decentralization of its network. Meanwhile, Ethereum, which also started with PoW, has completed its transition to Proof of Stake (PoS) with Ethereum 2.0, in line with its vision to expand as a more complete platform for decentralized applications.

In the following table, we look at how Bitcoin and Ethereum fit their unique purposes and challenges in terms of network architecture and consensus:

consensus

- Consensus algorithms: The consensus algorithm is fundamental to maintaining the security, integrity and decentralization of blockchain networks.

- Bitcoin uses Proof of Work (PoW) with ASICs, a process that requires miners to use specialized hardware to solve complex mathematical problems. This mechanism ensures that the network is resistant to attacks, as manipulating the blockchain would require a prohibitive amount of computing power. It is important to note, however, that this process consumes a significant amount of energy, which has raised concerns about its environmental impact and long-term sustainability.

- Ethereum has migrated to a Proof of Stake system (PoS) as part of its upgrade to Ethereum 2.0, where users can participate as validators by staking 32 ETH. Unlike PoW, in PoS validators are randomly selected to create new blocks and validate transactions based on the amount of ETH they have “in play” as collateral, allowing for greater scalability.

- Turing complete: Ethereum supports a Turing-complete programming language (Solidity, Vyper), that enables the creation of complex smart contracts. This capability is based on the Ethereum Virtual Machine (EVM), a key feature of the platform. In contrast, Bitcoin’s scripting language is intentionally limited to reduce security risks.

- Block size limits: Ethereum does not have a fixed block size limit in terms of kilobytes, but instead uses a “gas” system to limit the amount of computation and storage that a transaction or block can use. Bitcoin, on the other hand, sets a block size limit of around 1 megabyte, meaning that the number of transactions that can be included in a block is limited by this predefined size.

- Transaction per second limit: Both Bitcoin and Ethereum are working on scalability solutions, including second-layer solutions, to increase the number of transactions per second. At the base layer, Bitcoin has an approximate limit of 3 to 7 transactions per second, while Ethereum can handle between 10 and 30 transactions per second.

- Nature of transactions: As mentioned above, Bitcoin and Ethereum differ in the nature of their transactions. Bitcoin facilitates secure and direct financial exchanges, favoring simplicity and security. On the other hand, Ethereum uses smart contracts to enable more complex transactions, allowing the development of a variety of decentralized applications, from DeFi to NFTs, ranging from basic transfers to complex automated interactions.

- Anonymity and pseudo-anonymity: Both networks offer pseudoanonymity; however, Ethereum is actively exploring technologies such as zk-SNARKs and zk-STARKs to enhance privacy and anonymity in transactions and applications.

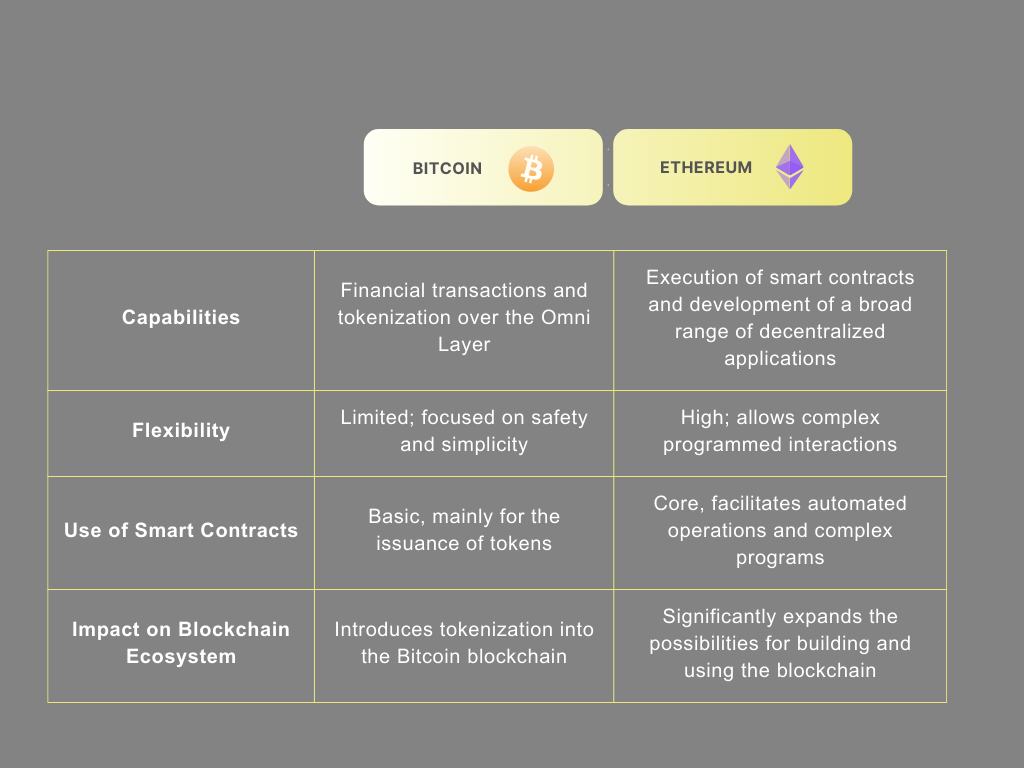

Smart contracts and applications

The introduction of smart contracts and the development of decentralized applications represent a critical advancement in the utility and scope of blockchain technologies. While Bitcoin was originally conceived as a digital currency and payment system, Ethereum’s capabilities have greatly expanded the possibilities of what can be built on top of a blockchain.

Bitcoin and Layer 2

Although the Bitcoin core does not support complex smart contracts in its base layer, the Omni (formerly known as Mastercoin) and Rootstock layers, are presented as second-layer solutions that are built on top of the Bitcoin blockchain. These platforms allow the creation of tokens and other digital assets that operate on top of the Bitcoin blockchain without altering its basic functionality, albeit within a more limited framework compared to Ethereum’s capabilities.

Ethereum and its essence

Since its inception, Ethereum has been proposed as a platform that goes beyond cryptocurrency transactions, facilitating the execution of smart contracts through its Ethereum Virtual Machine (EVM). Smart contracts in Ethereum are self-executing programs that operate when pre-defined conditions are met, enabling a wide range of applications. The flexibility and Turing-complete nature of Ethereum has driven innovation in the blockchain space, democratizing the development of decentralized applications.

As we have seen, the difference in approach between Bitcoin and Ethereum is significant. While Bitcoin has focused on consolidating itself as a store of value and digital medium of exchange, Ethereum has opened the doors to a world of programming and practical applications through its smart contracts. This distinction underscores not only the diversity of applications possible with blockchain technology, but also how different platforms can coexist for complementary purposes within the blockchain ecosystem.

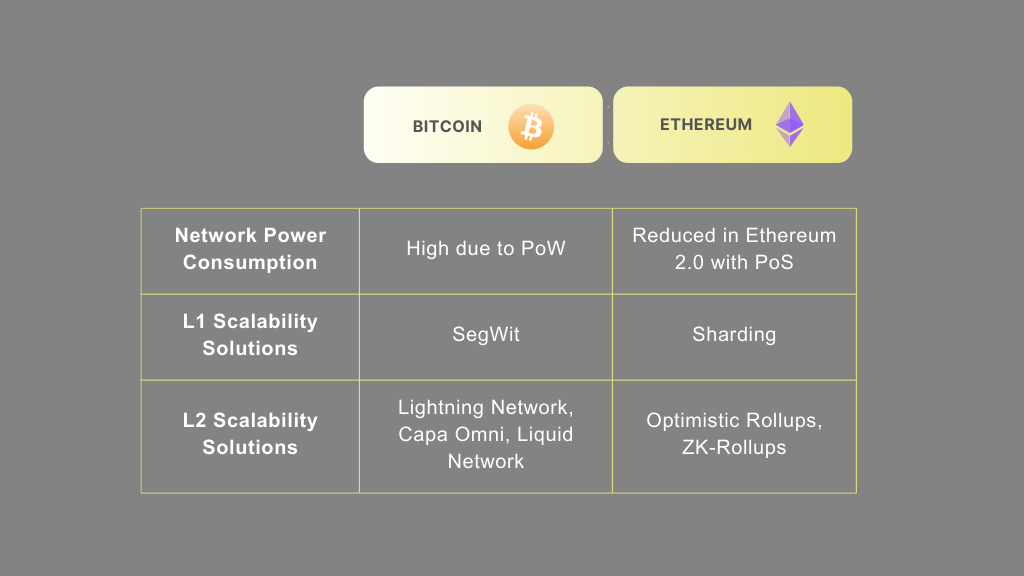

Scalability and future solutions

Addressing scalability is critical to success and widespread adoption. As these networks have grown, significant challenges have arisen regarding the volume of transactions they can efficiently handle.

Both platforms have researched and developed a variety of solutions to improve their scalability, including base layer (L1) enhancements and the implementation of second layer (L2) solutions, each offering different approaches to facilitate more transactions and applications.

Below is a simplified table that focuses on the scalability solutions implemented by Bitcoin and Ethereum.

- Network power consumption: The consensus mechanisms mentioned here use different amounts of energy depending on their nature.

- The PoW that Bitcoin uses is energy intensive because of the need to continuously run this high-powered equipment to maintain the network. According to this Cambridge University index, Bitcoin’s energy consumption currently stands at 173,24 TWh which is comparable to the total annual electricity consumption of countries such as the Netherlands or Sweden.

- By moving to PoS, Ethereum has reduced its energy consumption by an estimated 99.95% compared to the previous PoW system. According to the above index, Ethereum’s current annual consumption is approximately 6,03 GWh.

- L1 scalability solutions: These solutions involve modifications to the main blockchain to improve its performance and processing capacity. In Bitcoin, a solution such as Segregated Witness (SegWit) optimizes the block space by separating the transaction information from its digital signature, allowing more transactions per block. In the case of Ethereum 2.0, Sharding (danksharding) is implemented to divide the network into more manageable segments,significantly increasing its processing capacity and scalability.

- L2 scalability solutions: These refer to solutions built on top of the main blockchain to increase its capacity without changing the underlying structure. The Lightning Network in Bitcoin and the various implementations of Rollups in Ethereum are examples of this.

Governance and protocol updates

The governance process and implementation of protocol updates are essential to understanding how Bitcoin and Ethereum adapt and evolve in response to the changing needs of their ecosystems. This point highlights the different approaches both platforms take with respect to governance and how they manage significant updates to improve their functionality, security and efficiency.

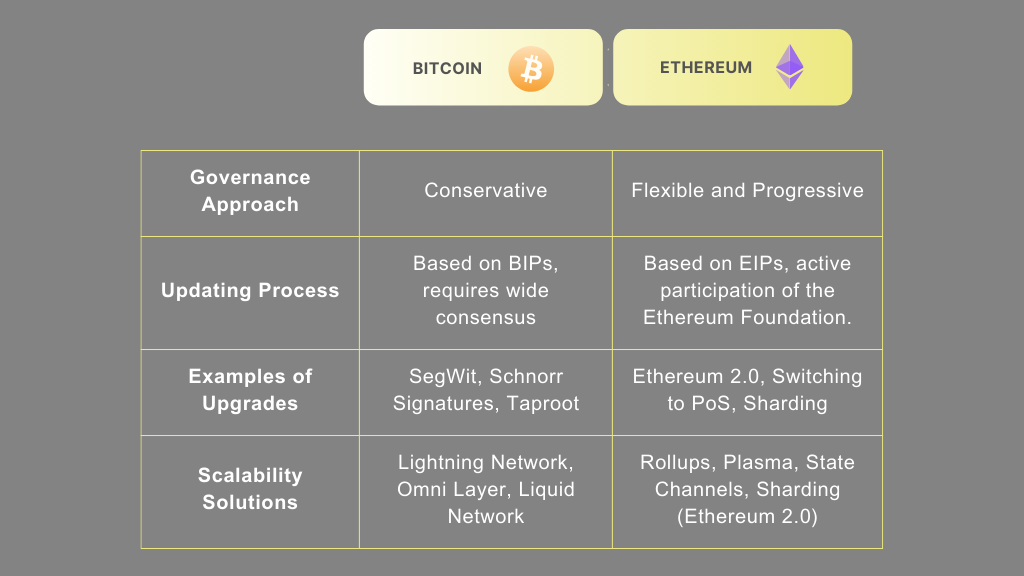

Below, we present this table with a focus on the upgrade process for both blockchains:

- Governance approach: Bitcoin tends to be more conservative in its governance process, focusing on security and stability, often resulting in a slower upgrade process. Ethereum, on the other hand, takes a more flexible and forward-looking approach, with the Ethereum Foundation and other developers playing an active role in proposing changes and evolving the platform.

- Update process: Both Bitcoin and Ethereum have structured processes for proposing, discussing and adopting improvements to their protocols. Bitcoin uses Bitcoin Improvement Proposals (BIP), while Ethereum uses Ethereum Improvement Proposals (EIP). These mechanisms allow the community to propose, discuss and ultimately implement technical changes and improvements to the network.

Conclusion

In short, while Bitcoin and Ethereum share the underlying blockchain technology, they differ significantly in their goals, capabilities and applications. Bitcoin revolutionized the idea of digital money by providing a decentralized, censorship-resistant payment system. Ethereum, on the other hand, has expanded the horizon of the blockchain into a global decentralized computing platform, enabling the creation of smart contracts and decentralized applications.

For developers and technology enthusiasts, the evolution of these platforms represents not only a fertile field for innovation, but also a fascinating case study in how technology can adapt and evolve to meet changing and emerging needs.

The continued development and refinement of these technologies will be critical to their long-term success and adoption as they seek to address scalability, security, and usability challenges to reach their full potential in the coming era of decentralized internet.

Resources:

[1] Ethereum and its evolution towards Ethereum 2.0

[2] The ultimate guide to the Bitcoin blockchain

[3] Cambridge Bitcoin Electricity Consumption Index

[4] Electric Capital: Developer Report 2023

Want to learn more about blockchain technology? Don’t miss these resources!

- Exploring the blockchain technology

- Harnessing the power of blockchain technology in businesses

- The Bitcoin halving: A pivotal event in the digital economy

At Block&Capital, experts in IT recruitment in Spain, the UK, the USA, and Andorra, we connect companies with exceptional tech talent. Our mission is to create opportunities where growth and success are within everyone’s reach. Contact us today to find the right IT talent for your company.

Last posts